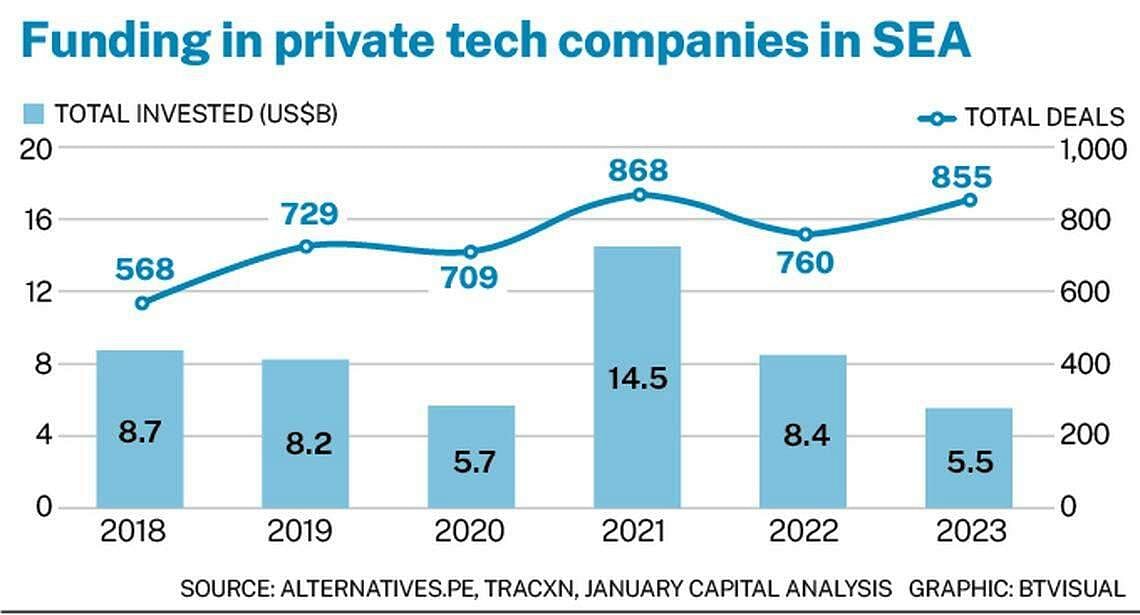

INVESTMENTS in private technology companies in South-east Asia fell 34.5 per cent to US$5.5 billion last year despite a rise in the number of deals, as venture capitalists redirected funds to younger companies.

The number of deals grew from 760 in 2022 to 855 in 2023, said a report by venture firm January Capital, which sourced data from Alternatives.pe and Tracxn.

Early-stage investments, where companies are new or have only a few years of operations, have been gaining traction. The smaller investment commitments and longer incubation period help diversify risk in an uncertain economy.

The average deal size at the seed stage last year was US$2.1 million, for instance, compared with US$23.5 million at Series B, January Capital’s analysis showed.

Tech dealmaking hit a peak in 2021, amid a Covid-19 boom that propelled funding to US$14.5 billion across 868 deals.

The report noted an outsized number of mega funding rounds that year, when at least US$100 million was raised in each round. In total, more than US$11 billion went to companies at Series B and above; in 2023, this number plunged to US$3.3 billion.

Funding in Series B companies fell from over US$2 billion in 2022 to over US$1 billion in 2023.

“The amount of capital invested in Series B/C companies continues to reduce quite dramatically,” the report said, attributing the bulk of the decline to limited Series D/E transactions in 2023.

E-commerce, fintech and software-as-a-service (SaaS) continued to be the largest contributors to deal count and funding in South-east Asian tech.

The proportion of capital that went into e-commerce, however, dropped from 54 per cent in 2019 to 10 per cent in 2023, as the regional startup ecosystem matured and other businesses emerged.

The proportion of fintech funding has grown steadily, from 15 per cent in 2019 to 31 per cent in 2023. January Capital noted a rapid increase in sustainability startups, with companies such as Blue Planet Environmental Solutions and Cosmos Innovation getting funded.

“While most sectors observed an increase in deal count year on year in 2023, SaaS, healthcare and e-commerce saw the most material increase,” the report said. “This may be driven by investors focusing their investment capital on more proven business models.”

Source: The Business Times.

Link: Here

March 21, 2024